Borrowers out of Basic Chartered which have a home loan admission size of ? thirty-five lakh to help you ? 3.5 crore can choose to invest precisely the notice count thru equated monthly obligations (EMIs) for an initial chronilogical age of 1three-years

Recently, Basic Chartered Bank circulated an interest-just mortgage facility for its current along with new mortgage users into the purchase of completed attributes. An attraction-only mortgage try a business where the borrower will pay precisely the interest accrued with the prominent a great to own a small period of the loan tenure. That period is known as the interest-simply period’. Zero prominent number would be deducted during this time period.

Borrowers away from Practical Chartered having a mortgage ticket measurements of ? thirty-five lakh so you’re able to ? step three.5 crore can choose to expend only the desire amount through equated monthly premiums (EMIs) to have a first chronilogical age of 136 months.

Reddish alert having most big rainfall given on these .

After that interest-just period is over, our home mortgage business was managed instance a consistent mortgage membership where in actuality the EMIs comprise of both prominent and you may desire up until the maturity of your own financing. This business is additionally getting lengthened to individuals who wish to transfer the current mortgage brokers away from another lender so you can Basic Chartered.

As per industry source, various other banking institutions could possibly offer notice-simply lenders with respect to the deals towards the debtor and you can this new cashadvanceamerica.net what is a variable rate loan terms of the loan. Often, the fresh builders or perhaps the developers of your property programs may tie-up with banking companies to incorporate attention-just financing to possess a specific several months into the home buyers.

Raj Khosla, inventor and you will managing director, MyMoneyMantra said, Interest-just mortgage brokers are often offered at under-structure properties and stay a stylish proposal since the dominant repayments start only if a house is ready to possess profession.”

Borrowers going for this 1 could possibly get remember that due to the fact bucks circulate weight about attention-only period precipitates, the general payment amount to the financial institution inside the entire period could be higher in such a case. Let’s take an example of a normal mortgage from ? 50 lakh from the a predetermined interest out of 8% to own a tenure of 3 decades. In this case, new monthly EMI count involves ? thirty six,688 as well as the full number payable dominant in addition to notice on whole period was ? step one.32 crore.

How Sapient Wealth’s Amit Bivalkar aced fourteen% output

For individuals who choose for a destination-simply name out-of 36 months (three-years) throughout the significantly more than example, new month-to-month away-come in the initial 36 months might possibly be ? 33,333. Then, the standard EMI plus prominent and you can attract from ? 37,713 starts. In this case, the total dollars outgo over the tenure of the property financing is ? step one.34 crore. The other accountability, in cases like this, is all about ? dos lakh. It is a simplified investigations. The amount can differ in case your floating interest are joined of the mortgage buyer.

Having said that, Khosla highlights as you are able to take advantage of this give because of the expenses this new differential level of EMI within the attention-only months. The guy told you, In the event your productivity of investments exceed the house mortgage interest, do not pay off the loan.”

In terms of tax, because there is zero principal fees from inside the attention-just period, deduction as much as ? step 1.5 lakh less than section 80C of one’s Income tax (IT) Act with the dominating portion of the EMI are not obtainable in such as for example several months. The interest number (to ? dos lakh in the eventuality of notice-occupied property) can be are said as an excellent deduction below area 24 of They Work. In case, interest-simply EMI is paid for the fresh new less than-design assets, the attention count try anticipate once the good deduction inside the four equivalent installments adopting the design is carried out.

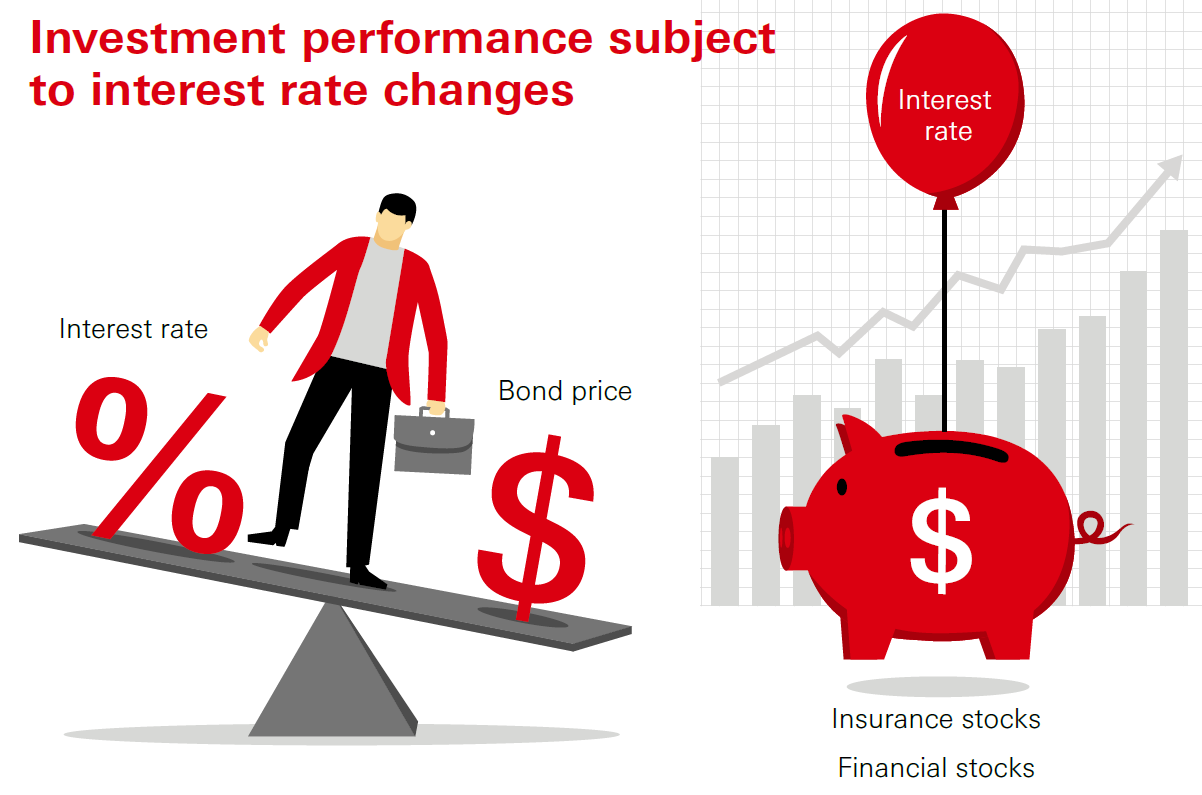

You really need to pick that one only when your financial means consult it. Extremely mortgage brokers are based on floating interest levels, and therefore alter having interest actions on the market. Since rates of interest is all the way down now, one could be much better off paying down the borrowed funds and you may turning down the latest an excellent accountability, offered the borrower can also be pay EMI, like the principal count.

Leave a Reply